Are You Insurable?

LTC Insurance is considered health insurance and has medical underwriting.

Percentage of applicants denied increases with age: Percentage of applicants denied increases with age: |

|

Age Age |

% of those who apply and cannot health qualify % of those who apply and cannot health qualify |

50-59 50-59 |

16% 16% |

60-69 60-69 |

24% 24% |

70-79 70-79 |

41% 41% |

Click for a list of Uninsurable Health Conditions and Medications. (pdf)

If you don't have any of the disqualifying conditions listed but do have health issues the next step is to pre-qualify your health. Fill out the request form and list your medications and health.

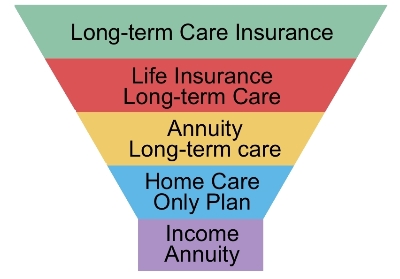

What if You Cannot Health Qualify?

There are multiple options depending on your health. The healthier you are the more choices you have and you get more insurance for your money.

Often through no fault of their own some people just cannot health qualify for traditional long term care insurance.

If you cannot health-qualify the next step is to determine what companies and insurance products are available.

We work with multiple companies and will help you find something to lessen the financial burden in the event that you need care.

Financial Qualifications

Not everyone qualifies financially but everyone should have a plan.

For those with no assets or who are low-income they would most likely be depending on state aid (Medicaid/welfare). Homeowners' estates may face repaying Medicaid for their care. See Medicaid, Filial Law and Family

Self-Insuring Your Long Term Care

For every $1,000 of monthly retirement income (to pay for care) you want to generate from your own savings, you will need about $230,000 in assets, according to the Schwab Center for Investment Research. For example, if you want $3,000 a month, or $36,000 a year, you would need savings of $690,000.

That's a conservative estimate, assuming that you earn 5.2% on your investments and live off the earnings without dipping into the principal. The national average annual cost for nursing home care is $79,000.

A long term care insurance policy that covers $3,000 a month might cost $1,000-$2,000 or more a year depending on age, health and other benefit options chosen. Most policy buyers choose a benefit that covers 40%-80% of the nursing home cost.

According to Medicare and Medicaid about 70% of Americans will need some long term care. Do the math.

Support Provided With A Long Term Care Insurance Policy

The non-financial side of long term care insurance is the support you get from the care coordinator. Ask anyone who has had to do this how much is involved and how stressful it was for them (and their family).

If you or your spouse needed care, who would you call? Would you look in the yellow pages for care providers? Who would you know to trust? You've heard the horror stories about theft and abuse by care givers. Why take a chance, let a professional help.

The care coordinator is not a gatekeeper; it is usually a local nurse who knows who knows everyone in your community that provides whatever you need for your care, be it a carpenter for home modifications, home care helpers, therapists or others.

This service saves you and/or your family from setting up and managing care, which can be very stressful and time consuming.

With LTC insurance you can have Care Management not Crisis Management

With experience of over 25 years in long term care planning our experts work with the largest and most financially secure insurance companies to make sure your future is protected. Your future is our future.

Long Term Care is a family affair.

The majority of caregivers are family members.