About long term care insurance and Partnership.

In these days of economic uncertainty it is essential that people have a sense of security and peace in terms of their future. Long term care insurance is a way to help preserve your independence.

What is Long Term Care?

First understand what is meant by long term care.

Long Term Care can be defined simply as care provided by another party for the benefit of someone who is unable to care for themselves.

Long term care is the kind of help you need if you are unable to care for yourself because of aging, an illness or a disability whether temporary or permanent.

It can range from help with daily activities at home, such as bathing and dressing, to skilled nursing care in a nursing home. An individuals care need could be a few months for recovery or many years.

Who Needs Long Term Care?

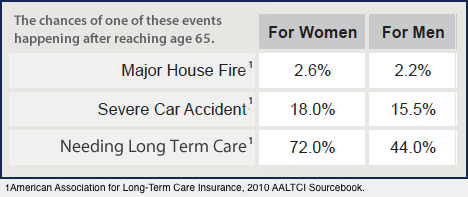

Most people start thinking about insuring for long term care in their 50s mainly because their parents or even some friends have required long term care. The fact is that you could need it at any age.

40% of all people receiving long term care are 18-64 years of age. People may use their LTC insurance multiple times, for example when recovering from a car accident or surgery, then later again when they are old and frail.

Most traditional long term care expenses are paid with personal or family assets. Neither traditional medical insurance nor Medicare pays for most long term care services, and Medicaid does not pay unless the individual qualifies for welfare assistance.

Long Term Care Insurance

Long term care insurance is a means of protecting your financial independence against the event of costly long term care in the future. Many financial experts today recommend long term care insurance as a key element for most personal financial and retirement plans.

If you needed long term care, how would that impact you and your loved ones? Long term care insurance can be a practical and affordable way to help pay for long term care services and a powerful asset to secure the services you desire.

Long term care insurance can help you maintain your independence, maintain control over how you spend your savings, and have more choice in who provides your care and where you receive it.

Download 2022 Tax Guide For Long Term Care

What is the LTC Partnership Program?

Section 6021 of the DRA (2005 Deficit Reduction Act) allows for Qualified State LTC Partnerships, which will permit States with approved State plan amendments (SPA) to exclude from estate recovery the amount of LTC benefits paid under a qualified LTC insurance policy.

For States that elect this option, the State plan must provide that, in determining eligibility for Medicaid, an amount equal to the benefits paid under a qualified LTC policy is disregarded.

The State must also allow, in the determination of the amount to be recovered from a beneficiary's estate, for the same amount to be disregarded. See Medicaid, Filial Law and Family

Each state has its own requirements for the LTC Partnership Program.

Select Your State

| Current New Partnership states. | ||||

| Original Partnership states. Policies are different than other states. |

|||

| At this time we do not have Partnership policies for CA, IN. | td>|||

Non-Partnership states:

|

Protecting Retirement Income

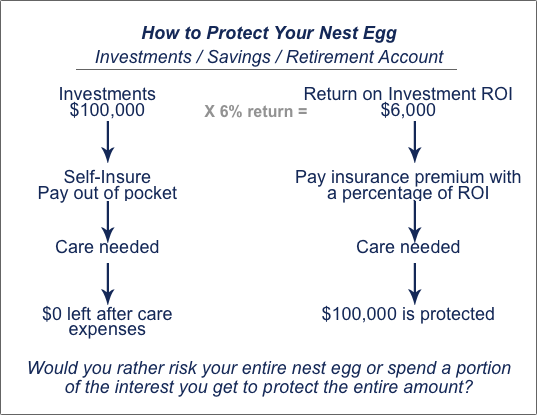

Even in these challenging economic times many people are looking to retire in the next few years and maintain their current lifestyle which makes this an opportune time to consider the value of long term care planning so you can feel safe and secure knowing you have some control in your future financially.

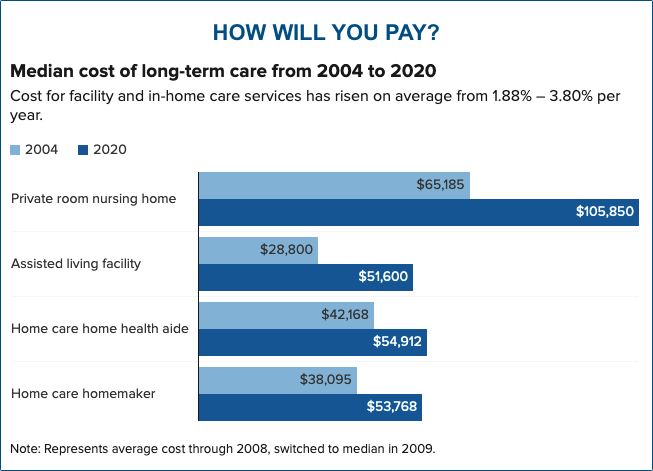

Most people plan on their retirement money to provide the income to maintain their lifestyle. It takes a $2 million investment portfolio to provide $100,000 a year if it has a 5% annual rate of return. The average cost for nursing home is over $75,000, which leaves $25,000. How much will you (and spouse) need to cover both long term care and living expenses (lifestyle)?

The largest group of people who buy long term care insurance are the ones who have had personal experience. They've seen others spend everything on care, the impact it had on them and their family and they don't want that to happen to their spouse and children.

LTC Insurance is like health insurance, it's for really big events, the kind that could cause you to use up all your savings and assets.

You have 5 options for financing long term care.

1. Self-insure: pay out-of-pocket.

2. Medicaid: requires spend-down to poverty.

3. Long term care insurance: Partnership asset protection in most states.

4. Life insurance: with a long term care rider (no Partnership asset protection).

5. Annuity: with a long term care rider (no Partnership asset protection).

Long term care planning can protect your income stream -- you might say that long term care planning provides the peace of mind that in the event that you need extended care your family's lifestyle could remain intact.

Only traditional long term care insurance qualifies for Partnership asset protection. The Life/LTC and Annuity/LTC plans do not qualify; neither do older policies sold before your state adopted Partnership. This includes group policies sold by AARP and other marketing outlets. See Is My Policy Partnership?

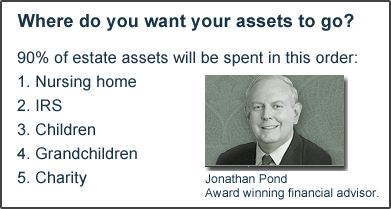

The Partnership protects your lifestyle and your estate legacy. In some states children may end up paying for their parents' care under the filial law.

Because the odds are 70% that you (and your spouse) will need long term care, you should set aside an average of $210,000 for care. That's $420,000 per couple based on the national average of 2.5 years and $70,000 per year.

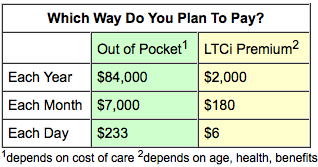

Or you can buy insurance. Either way you have a good chance of needing care and either way you are going to pay for it: out-of-pocket or insurance.

If you're the type that spends weeks or months looking into whether or not to buy long term care insurance and the horse gets out of the barn it's too late to close the door. You can't buy insurance after you need it.

Who Should Not Buy Long Term Care Insurance

A long term care policy would not make sense for someone with low income and little or no assets.

You probably should not purchase long term care insurance:

- if you currently receive or may soon receive Medicaid benefits

- if you have limited income/assets and can't afford the premiums over the lifetime of your policy

- if your only source of income is a social security benefit or supplemental security income.

If you are considering replacing an old long term care insurance policy make sure the new policy is affordable because it will cost more since you are older. It should also have benefits that your old policy lacks.

Sometimes you would be better off keeping your old policy and adding a second policy to cover what is missing in your first policy, for example Partnership asset protection.

If you have questions about your current policy, we will be glad to go over what you have and provide you with options.

Why People Buy Long Term Care Insurance

Here are six most common concerns about long term care and the reasons people buy long term care insurance:

- Burden - Do not want to be a financial or emotional burden on others.

- Access to quality care - Being able to select a quality facility in a location of my own choosing.

- Aversion to welfare (Medicaid) - Not wanting to be dependent on the government for care.

- Asset protection - Preserve assets for healthy spouse, inheritance for children or donation to charity.

- Control and independence - I want to maintain personal control in the choices I make.

- Peace of mind - Knowing I am protected instead of worrying about what could happen.

Most LTC insurance policy buyers do not insure for the entire nursing home amount, usually 50%-80% with the idea of co-paying the difference if nursing home care is needed.

The logic is "If I'm in a nursing home I'm not going on any cruises, so I'll pay the difference between what the policy pays and the nursing home cost out of pocket, at least I'm not paying the entire nursing home cost."

Most people would prefer to receive their care at home and studies show that insurance allows them to stay at home longer. See Claims

What If I Don't Qualify For LTC Insurance?

More people get turned down because of health reasons than for financial reasons. See Are You Insurable?

If someone doesn't health qualify they are now on the path to self-pay. But do not assume you cannot qualify. People who have had heart attacks, cancer, etc, some can still qualify. Get pre-qualified with a quote.

Applicants denied increases with age. |

|

| Age | % of those who apply and cannot health qualify |

Sometimes if one spouse cannot qualify for long term care insurance they both won't want the insurance. This is an emotional reaction.

How does that make sense? The situation is that if only one spouse can be insured then the money can be used for the non-insured spouse's long term care.

Often if one spouse has insurance and the other doesn't and needs care they are very relieved that they have some protection. They might need all the money they have left after paying for care for the uninsured spouse to stay out of financial trouble.

Here is something that insurance companies wouldn't necessarily want you to know about or do. If one spouse has health issues that may disqualify them, you should be sure to indicate you are a couple when you apply. That way the spouse that is applying will still be able to get a partial couples discount.

With some insurance companies "couples" can apply not only to married people, but also to two people who have lived together in a committed relationship and shared basic living expenses for at least 3 years.

"Considering that the average cost of nursing home care is approximately $70,000 a year, and home care costs can range from $50 to more than $200 a day, long term care insurance makes a lot of sense for millions of Americans." - Chicago Tribune

How Much Does Long Term Care Insurance Cost?

Since state requirements can be different and each person is different the only way to know what your individual options are is to get a quote customized for your needs and preferences.

Premiums are based on your age, and two main benefit factors: the daily or monthly benefit amount and benefit term or years. If you have a health problem you may not be able to get insurance or may have to pay a higher premium.

Generally companies offer benefits ranging from $50 to $400 a day ($1500-$12,000/month) and benefit terms for 2, 3, 4, 5, 6, years. Depending on your age, health and benefits chosen, premiums can run from under $1000 a year to over $5000 a year.

What to Look For in a Long Term Care Insurance Policy

A long term care insurance policy helps put you in control when you need it most - by helping to protect your assets and to ensure that you receive quality care in the setting you want. That's why it's so important to select a policy that's right for you.

A good plan design when judging policies is the National Association of Insurance Commissioners' (NAIC) model laws and regulations, which recommends:

* At least one year of nursing home or home health care coverage, including intermediate and custodial care. Nursing home or home health care benefits shouldn't be limited primarily to skilled care.

* Coverage for Alzheimer's disease.

* An inflation protection option.

* An "outline of coverage" that systematically describes the policy's benefits, limitations and exclusions, and lets you compare it with others.

* A guarantee that the policy cannot be canceled, non-renewed or otherwise terminated because you get older or suffer deterioration in your physical or mental health.

* The right to return the policy for a full premium refund within 30 days, if after having received the policy, you decide you don't want it.

* Options that enhance your policy such as Shared Benefits for couples, Home Care elimination period waiver.

* No requirements that policyholders first:

- Be hospitalized in order to receive nursing home benefits or home health care benefits.

- Be hospitalized in order to receive nursing home benefits or home health care benefits.

- Receive skilled nursing home care before receiving intermediate or custodial nursing home care.

- Receive skilled nursing home care before receiving intermediate or custodial nursing home care.

- Receive nursing home care before receiving benefits for home health care.

- Receive nursing home care before receiving benefits for home health care.

Also, be sure to consider the company behind the plan. Look at its track record in terms of experience in long term care insurance, as well as its ratings for financial stability and claims complaints.

That means you will need help with at least two of the six Activities of Daily Living (ADLs) for at least 90 consecutive days. These activities include bathing, dressing, eating, transferring, toileting and continence. You also are eligible for benefits if you are certified to need continual supervision due to a severe cognitive impairment.

When researching for a long term care insurance plan you want one that requires the insured to need help with only two (2) ADLs to trigger benefits for home, community, or nursing home care.

Some plans, especially group plans require the insured to need help with three (3) ADLs for nursing home benefits to be triggered. This means you may have to wait a lot longer before the insurance pays.

We will be glad to work with you to design a plan just for your needs. We have over 30 years of experience and work with the top long term care insurance companies.

Payment modes are pretty much the same for all companies. As with most insurances, the more frequently you pay the more it will cost per year.

The schedule for getting long term care insurance:

![]() First, fill out the online form that has the information necessary to provide you with pre-qualification quotes from different companies.

First, fill out the online form that has the information necessary to provide you with pre-qualification quotes from different companies.

![]() Second, you will be contacted by phone to schedule a telephone meeting during which you will be viewing an online chart where you can compare different plans from different companies and see how the prices change when you select different benefits.

Second, you will be contacted by phone to schedule a telephone meeting during which you will be viewing an online chart where you can compare different plans from different companies and see how the prices change when you select different benefits.

![]() Third, once you have selected the options you want quoted you will be emailed one or more quotes with brochures and other information.

Third, once you have selected the options you want quoted you will be emailed one or more quotes with brochures and other information.

![]() Fourth, review your quote and information and if needed our specialists can answer all of your questions by phone or email.

Fourth, review your quote and information and if needed our specialists can answer all of your questions by phone or email.

![]() Fifth, you choose the company and plan you want, and we send you the application by mail or email.

Fifth, you choose the company and plan you want, and we send you the application by mail or email.

![]() Sixth, complete the application and return it.

Sixth, complete the application and return it.

![]() Finally, if the application is approved a policy is issued and sent to you. You will have 30 days to decide to change benefits, buy the policy or cancel the policy.

Finally, if the application is approved a policy is issued and sent to you. You will have 30 days to decide to change benefits, buy the policy or cancel the policy.

Since 1983 we have been providing long term care planning. Our experts work with the largest and most financially secure insurance companies to make sure your future is protected. Your future is our future.

Long Term Care is a family affair.

The majority of caregivers are family members.